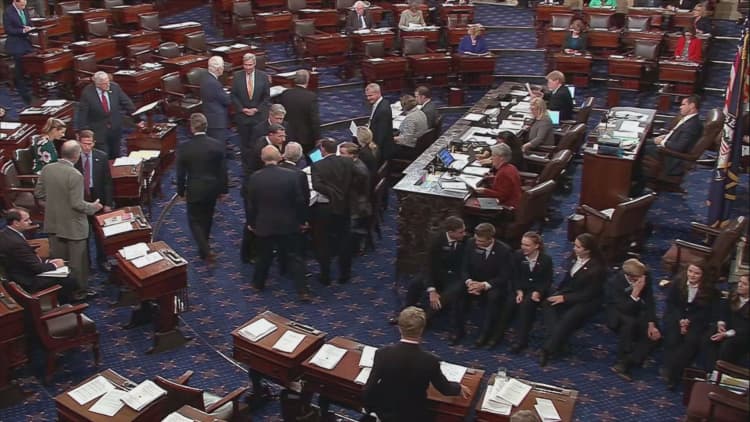

The House on Thursday narrowly approved a Senate version of the 2018 federal budget, clearing the way for the GOP-controlled Senate to pass a massive set of tax cuts later this year.

The vote was a nail-biter, with the final tally 216 to 212. House Speaker Paul Ryan, R-Wis., who typically doesn't vote on legislation, voted for the budget.

By passing the Senate version of the budget, House Republicans kick-started the reconciliation process, a window during which the Senate can pass legislation with only a simple majority, instead of the 60 vote supermajority typically needed to end debate and move a bill to a vote.

Yet signs of the fight looming on Capitol Hill over how to pay for the $1.5 trillion in tax cuts were already visible Thursday, when a number of Republicans from states with high state taxes voted against the budget bill, as did a handful of fiscal archconservatives.

Among the no votes from New York were Republican Reps. Peter King, Lee Zeldin, John Faso, Elise Stefanik and John Katko; noes from New Jersey included Reps. Frank LoBiondo, Tom MacArthur and Leonard Lance.

These members hoped that by stalling the tax-reform process, they might gain enough leverage to protect a popular deduction for state and local taxes, known as the SALT write-off. The current GOP tax framework calls for eliminating the SALT deduction to help pay for the tax cuts.

But this would likely have a disproportionate impact on middle-income taxpayers in places like New York, New Jersey and California, and as of late Wednesday, it was still unclear how many of the 30 Republicans who represent high-tax states would vote against the budget.

"Why should I vote for something that would end up decimating my district?" King told Reuters on Wednesday.

Also among the no votes were some of the most fiscally conservative members of the House Republican caucus, who were concerned that the budget contained too much spending. Shortly before the vote, the House Liberty Caucus released a statement opposing the budget.

With the budget vote out of the way, Republicans must now move on to the brass tacks phase of reforming the tax code. Shortly after the vote on Thursday, House Ways and Means Committee Chairman Kevin Brady, R-Calif., announced that a tax reform bill would be formally introduced on Wednesday, with a markup in his committee slated to begin Nov. 6.

"Today is a historic day, and we are ready to deliver tax relief that improves the lives of middle income Americans and struggling families who have been left behind in our slow-growing economy," Brady said in a statement.